Orlando Real Estate Market Report - 1st Half of 2017

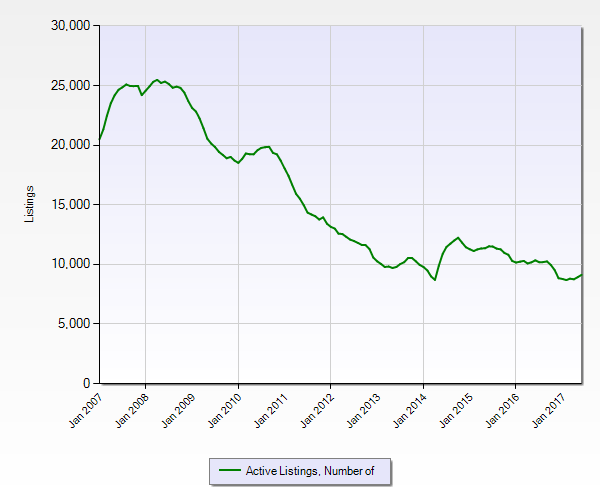

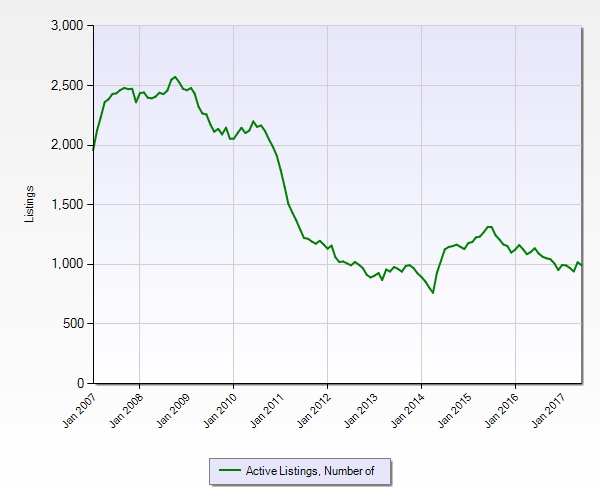

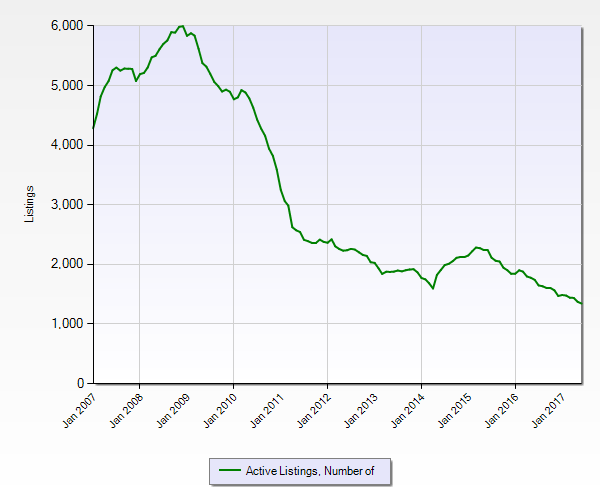

As we get ready to start the month of August, it is a great time to reflect back on the 1st half of 2017 to look for trends and get a better understanding of the current real estate market. Inventory has continued its decline and remains at historical lows as the number of available properties was unable to keep up with the demand and interest levels from both buyers and investors. Needless to say, home sellers are reaping the benefits as the conditions of the market are completely in their favor for most local neighborhoods & sub-markets.

Comparing the first half of 2017 to the first half of 2016, the current activity is lower simply due to the lower number of available properties. Despite this, sales activity has been extremely consistent over the course of the past year & this year, the trend is expected to continue with above average sales activity.

NUMBER OF ACTIVE LISTINGS IN ORLANDO MSA | 2007-2017

| Single Family Homes | Townhomes | Condos |

|  |  |

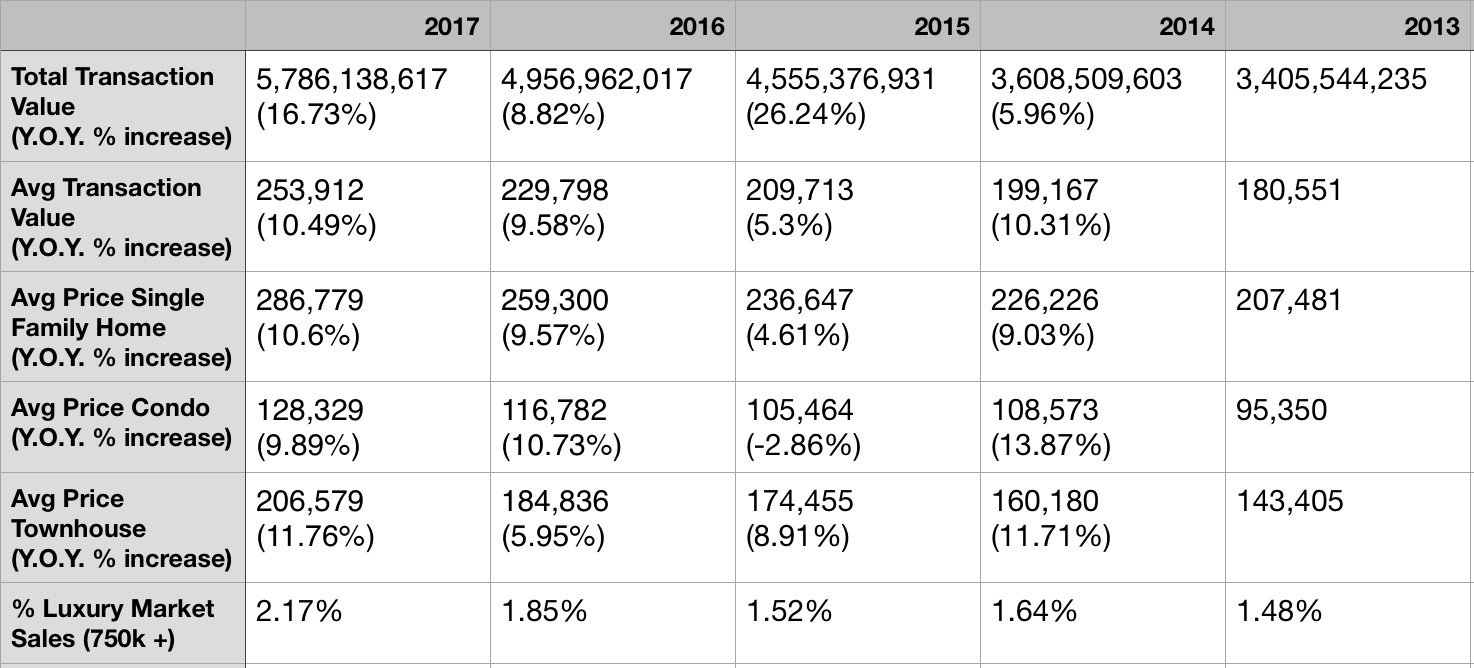

The Numbers

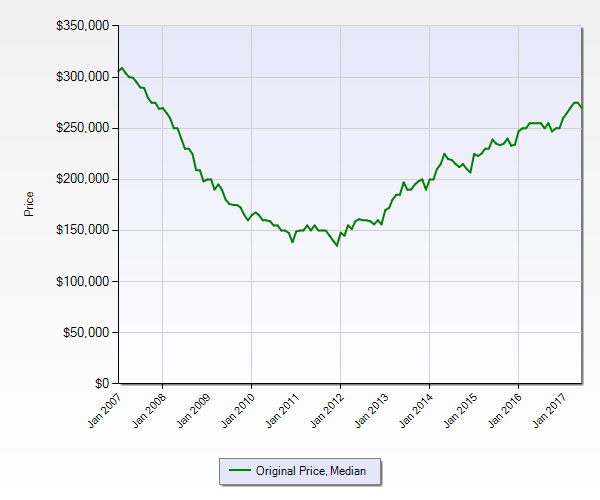

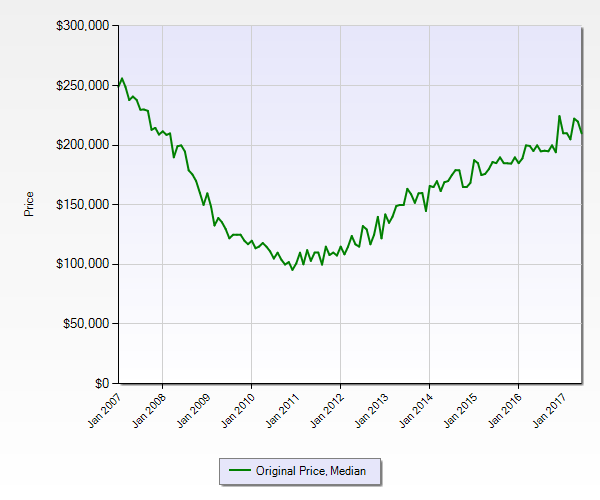

Given the current market conditions pictured above and the law of supply vs demand, it is easy to see why both the total value of all transactions & the average transaction value have increased compared to the same timeframe in the prior year (Jan 1 - June 30, 2016).

Jan-June 2017 compared to Jan-June 2016

| METRIC | NUMBER |

Total Transaction Value | 16.73% increase |

AVG Transaction Value | $253,912 (10.49% increase) |

AVG price of single family home | $286,779 (10.6% increase) |

AVG price of condos | $128,329 (9.89% increase) |

AVG price of townhomes | $206,579 (11.76% increase) |

Value of Luxury Market | $750,000+ (2.17% of all transactions) |

Here is a look at the breakdown for the 1st half of the past 5 years:

And Graphs for Orlando Median Sales Prices from 2007-2017

| Single Family Homes | Townhomes | Condos |

|  |  |

So What Does This Mean For You?

Inventory continues to decline, especially in the starter home range due to increased construction costs leading to less new development, while demand continues to rise which is going to have an extreme impact on future market activity.

With a few key dates & decisions coming up by October of this year including two Federal Reserve meetings, as well as the deadline for the government's debt ceiling decision, it is worth keeping a close eye on the residential market, but given the current conditions, we still expect to see:

- Inventory to continue to decline

- The current seller's market to continue (for most areas except those local submarkets with a bevy of new construction in the area) through the end of 2017 due to the above and other various factors

- Continued buyer & investor confidence

The Bottom Line...